Three of the Top Alternative Payment Methods in eCommerce

Reading Time: 3 minutesThe main objective of most businesses are to sell products or services. For an eCommerce Solution, to exchange money online a business will require a ‘Payment Gateway’

Payment Gateways essentially will allow you to:

- Accept payments swiftly, and with little effort.

- Keep customers transaction details secure.

- Gain customer trust and loyalty.

- Offer options that will integrate with an eCommerce custom design.

Payment gateways for business have a huge market, so for your business there are many options to choose from, however this article will focus on three top contenders: PayPal, Amazon and Google Wallet.

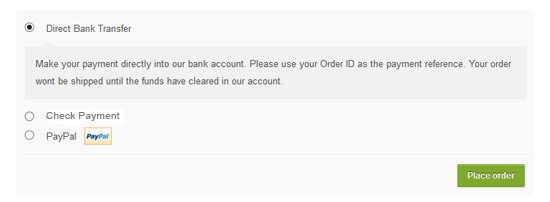

1) PayPal Payments

Launched in 1990, one of the most popular options has been PayPal. For a very small fee (low as 2.2%), at a basic level the user can very effortlessly install a button to their checkout page. Customers can just as easily click on it with funds immediately transferred. Convenience is obviously one of PayPal’s best features.

PayPal makes transactions easy!

Setup is also easy with PayPal, while the advanced user may use tools available for a more custom approach. For mobile businesses, PayPal have introduced PayPal Here Reader (similar to Square, a close competitor). This fast, flexible and easy option allows payment transactions with your smartphone or tablet.

PayPal Here Reader with Square, efficient tools for any mobile business

2) Amazon Payments

Similar to Amazon.com check out experience, Amazon Payments offer another option to buy and pay immediately. Its greatest advantage over its competition is its one click button. For merchants, this is very convenient as with one click, you submit all your transaction details. In real life it may be bulky, but online, it is a welcomed thought. This option has the same set-up as PayPal. So, if you are already familiar, installing this to your website will be quite easy. Rates start at 2.9% + $.30 per transaction, however it is unfortunately much higher for payments under $10.

Amazon Payments is not without any glitch. Its disadvantage is that you must use Amazon Seller Central, and confirm every transaction before it can be submitted. Essentially this may not be the custom design solution that most might want.

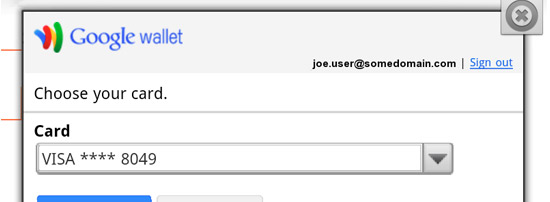

3) Google Wallet

Google, have been tapping in every idea that could possibly be brought online. Alternative payment methods were obviously to be one of them, and they had a good start, mainly because most would already expect big things from them. However, it was a letdown for some and did not pick up as much as its competition.

Google Wallet, a virtual wallet that saves you time and money

Unlike the two which were previously mentioned, Google Wallet offers many options in its installation, particular useful for custom designs. Features include:

- Pre-installed shopping cart

- Buy now button

- Add a gadget or cart

- Integration of Wallet through HTML or XML

Rates are very similar to PayPal and Amazon staring at 2.9% plus $0.30 for each transaction under $3000. As with all of Google services, only one account is required which is a huge advantage when managing other tools such as Adwords and Analytics.

The conclusion? Which one?

In all honesty it is worthwhile to investigate all options (see Wiki Payment Gateway Options), each will have their strengths and weaknesses that will appeal to some businesses and perhaps less to others. Review what is important for your business, plan a strategy, and make sure that it is right for your customer. Once a gateway has been decided on, there are always options to added other payment methods in the future.